Starting Business in India

With time India has become a lucrative investment destination for carrying on businesses.

The major advantage of setting up business in India are:

-

India is one of the fastest growing economy in the world.

As per the International Monetary Fund (IMF), India is to remain as the fastest Growing economies in the world. We could see an immense increase in the FDI inflows after the launch of Make in India initiative. India has become an attractive destination for setup of Industries.

-

India has a huge domestic market.

India being having second highest population in the World has a huge domestic market of 130 billion people. Indian consumer durables market is broadly segregated into urban and rural markets and is attracting marketers from across the world. The sector comprises of a huge middle class, relatively large affluent class and a small economically disadvantaged class. Global corporations view India as one of the key markets from where future growth is likely to emerge. The growth in India’s consumer market would be primarily driven by a favorable population composition and increasing disposable incomes.

-

India has the largest youth population in the world.

Young people are innovators, creators, builders and leaders of the future. This presents an enormous opportunity to transform the future. India would be the largest supplier of university graduates in the world in near future. As per the survey report of All India Management Association and the Boston Consulting Group, India has the third Largest group of Scientists and technicians in the world. This provides an excellent human resource to the investors.

-

Stable Government.

India has maintained a strong parliamentary democracy since its political freedom from Britain some 70 years ago. The country’s economy has propelled to become the third Largest in the world in terms of Purchasing Power Parity (PPP). With the continuous support of the Government, India has drastically improved its ranking in the world in the segment of Ease of doing business.

-

Best Connectivity and rising economic influence.

India has a huge maritime zone the southern peninsula is surrounded by Arabian sea in the west, Indian Ocean in the south and Bay of Bengal to the east. Centre of Global maritime trade to be moved from the Pacific to the Indian Ocean region, which will provide a great opportunity. It has been predicted that India will have a greater economic influence across the Asia Pacific Region.

-

Tax Benefit.

Recently India has provided huge tax benefits for the Indian Companies. Currently following corporate tax rates are applicable

- Manufacturing Companies – 15%

- Other companies without claiming any other deduction prescribed under law – 22%

These corporate tax rates are among the lowest corporate tax rates in the world which provides huge benefits to the foreign investors to start business in India.

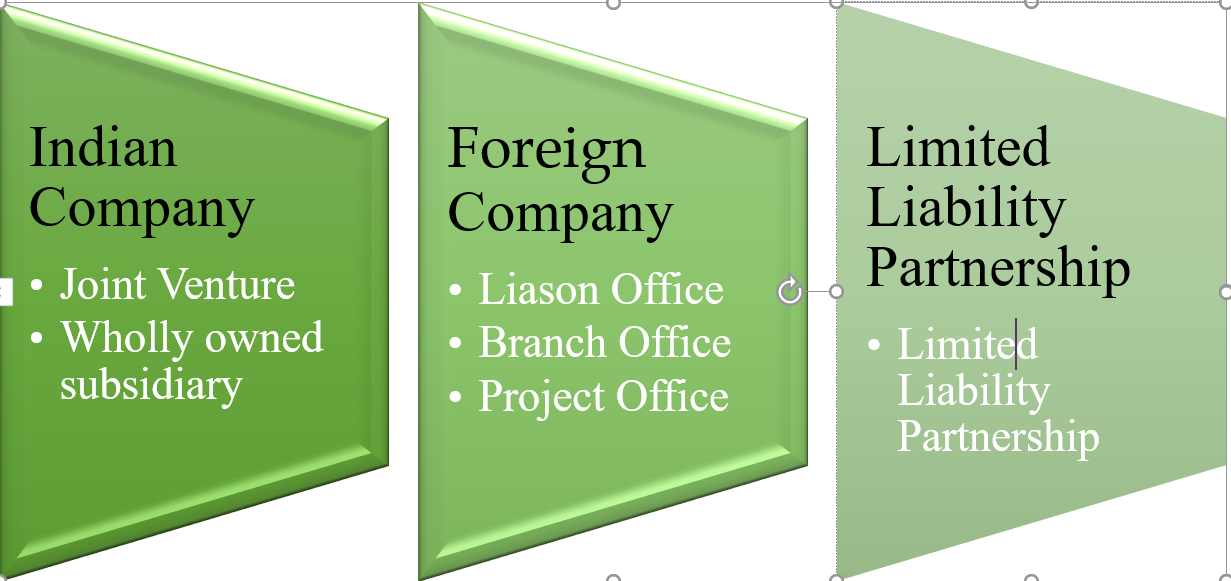

Types of establishment that a Foreign Entity can start in India.

The Foreign Investor can commence Business in India as

- Indian Company

- Foreign Company

- Limited Liability Partnership

Indian Company

-

Joint Venture

As per the companies Act, 2013, Joint Venture means a joint arrangement whereby the parties that have joint control of the arrangement have rights to the net assets of the arrangement

This kind of structure is available in across all sectors in India. However, it is prevalent majorly in high technology, high capital or high technical skill sectors. For example, Insurance companies are required to be owned and controlled by the Indian company as per the Insurance Regulatory Development Authority of India, therefore many international insurance companies have formed Joint Venture with the Indian Companies.

Strategic alliances and technology-transfer agreements between Indian and foreign partners can be seen in the sector of technology, media and telecom sectors, which provide great investment opportunities in diverse areas such as software development, hardware, print media, sports and outsourcing.

-

Wholly Owned Subsidiary

A wholly owned subsidiary is a company whose common stock is completely (100%) owned by a parent company. By establishing wholly owned subsidiary, the companies have an advantage such as direct and independent presence in the target country, Independent marketing, pushing of own strategies, easy alignment of own structures.

This is the most common form of establishment that multi-national companies opt for setting up of business in India with greater control on decision making.

It can be in the form of Private Limited Company, Public Limited Company or One Person Company subject to the provisions of the Companies Act, 2013. There are stringent rules in case of Public Limited company as compared to a private limited company and One Person Company.

Foreign Company

-

Liaison Office

A Liaison Office or representative office can only be engaged itself into the liaisoning activity i. Its role is limited to collecting information about possible market opportunities and providing information about the company and its products to prospective Indian customers.

A Liaison office cannot engage itself in any kind of business activities in India not it can earn profits in India. The expenses of the liaison office should directly come from the foreign company.

Advantage of Liaison Office setup is to represent the foreign company in India, promote export and import from or to India, promote technical/financial collaboration between Indian and the Foreign entity.

Eligibility:

Profit making track record during the immediately preceding three financial years in the home country and net worth of not less than $ 50,000 or its equivalent.

-

Branch Office

Branch office is established to represent the parent/group companies to undertake following activities

- export/import of goods;

- rendering professional or consultancy services;

- carrying out research work, in which the parent company is engaged;

- promoting technical or financial collaborations between Indian companies and parent or overseas group company;

- representing the parent company in India and acting as buying/selling agents in India;

- rendering services in information technology and development of software in India;

- rendering technical support to the products supplied by the parent/ group companies and foreign airline/shipping company.

A branch office itself can be a profit making entity and the funds from the branch office can be easily remitted outside India, subject to the payment of due taxes as per the provisions of the Income Tax Act.

Restricted activities in case of Branch office are

- Retail trading activities

- Setting up of manufacturing except unit in special economic zone in india and processing unit in India

Eligibility:

Profit making track record during the immediately preceding five financial years in the home country and net worth of not less than $ 100,000 or its equivalent.

As per the FDI norms general permission to non-resident companies for establishing BO in the Special Economic Zones (SEZs) to undertake manufacturing and service activities subject to:

-

- BOs are functioning in those sectors where 100% FDI is permitted

- BOs comply with Chapter XXII of the Companies Act, 2013

- BOs function on a stand-alone basis

-

Project Office

A foreign company may open a project office in India provided it has secured a contract to execute a project in India. However it must fullfill the follwing conditions:

- The Project is funded directly by overseas inward remittance or funded by bilateral/multilateral international financing agencies.

- The project has been cleared by the appropriate authority.

- The Indian company or other business entity awarding the contract has received project finance by way of a term loan from an indian Public financial institution or bank

Exception:

If the above-mentioned conditions are not fulfilled or the foreign based parent company is incorporated in Pakistan, Bangladesh, Sri Lanka, Afghanistan, Iran or China, the application of registration should be sent to the Foreign Exchange department for the prior approval.

Limited Liability Partnership (LLP)

LLP is a partnership structure of business where each partners liability is limited to the amount of capital contributed by them. This kind of setup is governed by the Limited Liability Partnership Act, 2008. It has an essence of corporate structure and the compliance part is less as compared to the company kind of establishment.

Brief comparison of the allowed kind of establishment:

| PARTICULARS | PRIVATE | PUBLIC | OPC | LLP |

| Min Members | 2 | 7 | 1 | 2 Partners |

| Max Member | 200 | Unlimited | 1 | No Limit |

| Min Directors/Partners | 2 | 3 | 1 | 2 Designated Partner |

| Max Directors/ Partners | 15* | 15* | 15* | NA |

| Resident Director | 1 Mandatory | 1 Mandatory | 1 Mandatory | 1 Designated Partner |

| Transfer of ownership | Ownership can be transferred | Ownership can be transferred | Ownership can be transferred to nominee in the event of death of owner | Ownership can be transferred |

| Subscription of shares | Public subscription not allowed | Public subscription allowed | Public subscription not allowed | Public subscription not allowed |

| Issue of Prospectus | Not Mandatory | Mandatory | Not Mandatory | Not Mandatory |

| Managerial Remuneration | No limit for managerial personnel | Shareholder approval is required, if remuneration payable is above limits | NA | Remuneration is based on LLP agreement |

| Commencement of Business/ Operations | Declaration to be filed prior to commencement | Declaration to be filed prior to commencement | Declaration to be filed prior to commencement | Immediately after obtaining certificate of incorporation |

| Legal Status | Pvt Co is a separate legal entity registered under Companies Act, 2013. The Directors are liable for defaults made under the act | Public Co is a separate legal entity registered under Companies Act, 2013. The Directors are liable for defaults made under the act | OPC is a separate legal entity registered under Companies Act, 2013. The Directors are liable for defaults made under the act | LLP is a separate legal entity registered under LLP Act, 2008. The Designated partners of LLP are liable for contraventions under the act |

| Governing Act/ Law | Companies Act, 2013 | Companies Act, 2013 | Companies Act, 2013 | LLP Act, 2008 |

| Annual Statutory Filings | Annual statement of accounts & annual return with ROC | Annual statement of accounts & annual return with ROC | Annual statement of accounts & annual return with ROC | Annual statement of solvency & annual return with ROC |

| Annual Filings & Audit | IT return to be filed. Audit mandatory | IT return to be filed. Audit mandatory | IT return to be filed. Audit mandatory | IT return to be filed. Audit mandatory in case turnover exceeds INR 40 lakhs or contribution exceeds INR 25 lakhs |

FDI Rules for setup of business in India.

Over the period of time India has liberalized its Foreign Direct Investment (FDI) policy to encourage and motivate investors to come and setup their establishment in India. In the curent scenario the foreign company can bring its investment in India through the following routes

A non-resident entity can invest in India, through the following route except in certain specified sectors/activities which are prohibited.

- Automatic Route

Under the automatic route, the non-resident investor or the Indian Entity in which the funds are to be introduced are not required to take any approval from the government of India. The Indian entity is only required to inform the RBI by filing requisite forms in respect to the amount received.

- Government Route

There are certain critical sectors where prior to investment, approval from the Government of India is required. Also such proposals are taken care by the respective government department. List of Sectors where government approval are required are as follows:

Government Route +Automatic Route (Required above certain threshold limit)

- Air Transport Services (Scheduled air transport services, regional air transport services)

- Banking- Private Sector

- Biotechnology (Brownfield)

- Defense

- Healthcare (Brownfield)

- Pharmaceuticals (Brownfield)

- Private Security Agencies

- Telecom Services

Government Route

- Banking – Public Sector

- Broadcasting Content Services

- Core Investment Company

- Digital Media

- Food Products Retail Trading

- Mining and mineral separation of titanium bearing minerals and ores, its value addition and integrated activities

- Mining and mineral separation of titanium bearing minerals and ores, its value addition and integrated activities

- Multi Brand Retail Trading

- Print Media (Publication/ printing of scientific and technical magazines/specialty journals/ periodicals and facsimile edition of foreign newspapers)

- Print Media (Publishing of newspaper, periodicals and Indian editions of foreign magazines dealing with news and current affairs)

- Satellites – establishment and operation

Prohibited Sectors where FDI are not allowed are:

- Lottery Business including Government/private lottery, online lotteries, etc.

- Gambling and Betting including casinos

- Chit Funds

- Nidhi Company

- Trading in Transferable Development Rights (TDR)

- Real Estate Business or Construction of farm houses (Real estate business shall not include development of town shops, construction of residential/ commercial premises, roads or bridges and Real Estate Investment Trusts (REITs) registered and regulated under the SEBI (REITs) Regulations, 2014)

- Manufacturing of cigars, cheroots, cigarillos and cigarettes, of tobacco or of tobacco substitutes

- Sectors not open to private sector investment- atomic energy, railway operations (other than permitted activities mentioned under the Consolidated FDI policy). However recently the Government of India have further liberalized and allowed FDI investment in sectors such as atomic energy etc.

Procedure for Government Route Approval

- Online Application to be filed at fifp.gov.in/

- Internal procedure for approvals

- DPIIT will identify the concerned Ministry/ Department and thereafter, circulate the proposal within 2 days. In addition, once the proposal is received, the same would also be circulated online to the RBI within 2 days for comments from FEMA perspective.

- Proposed investments from Pakistan and Bangladesh would also require clearance from the Ministry of Home Affairs.

- DPIIT would be required to provide its comments within 4 weeks from receipt of an online application, & Ministry of Home Affairs (if applicable) to provide comments within 6 weeks.

- Pursuant to the above, additional information/ clarifications may be asked from the applicant which is to be provided within 1 week.

- Proposals involving FDI exceeding INR 50bn (approx. $ 775 mn) shall be placed

- The approval is granted within 8-10 weeks.

FDI Reporting Requirement

After the funds are received in India the allotment of the shares is to be completed within 60 days from the date of receipt of funds as per the Ministry of Corporate Affairs, however under the FEMA the time limit is prescribed as 180 days. Therefore, it is advisable to complete the formalities with 60 days of the receipt of the funds. After the allotment proceedings are completed, Form FC-GPR (SMF) has to be filed with the RBI within 30 days of the allotment.

***