Multilateral Instruments (MLI) and Its impact on India

What is MLI?

Multilateral instruments (MLI) stands for Multilateral convention to implement tax related measures to prevent base erosion and profit shifting. This instrument is contained in action plan 15 of BEPS Project. The MLI allows jurisdictions to swiftly implement measures to strengthen existing tax treaties to protect governments against tax avoidance strategies that inappropriately use tax treaties to artificially shift profits to low or no-tax location. These instruments provide protection against treaty shopping by the corporates to shift or avoid tax. The measures to be implemented put an end to treaty abuse and “treaty shopping” by transposing in existing tax treaties jurisdictions’ commitment to minimally include in their tax treaties tools to ensure these treaties are used in accordance with their intended object and purpose. The MLI further enhances treaty-related dispute resolution mechanisms. In addition, over 30 jurisdictions decided to introduce, via the MLI, an arbitration procedure in their tax treaties, which further improves tax certainty. As of now 90+ jurisdictions are covered, 2800+ treaties are listed and 1680+ treaties to be modified due to MLI application.

It entered into force on 1 July 2018 and started to take effect with respect to covered tax agreements of jurisdictions that ratified it.

BEPS recommendations

The MLI includes the following measures (actions) of BEPS project

Hybrid mismatch arrangements (Action 2):- Hybrid mismatch arrangements exploit the differences in tax treatment of an entity or instrument under the laws of two or more tax jurisdictions to achieve double non-taxation, including long-term deferral. This action plan deals with Neutralising the effect of Hybrid Mismatch Arrangements. It contains two parts, Part I deals with addressing the mismatch of tax outcome arises due to payments made under a hybrid financial instrument or payment made to or by a hybrid entity.

Treaty abuse (Action 6): This action contains the measures for Preventing the Granting of Treaty Benefits in Inappropriate Circumstances. These measures deals with treaty shopping by the companies which involves strategies through which a person who is not a resident of a State attempts to obtain benefits that a tax treaty concluded by that State grants to residents of that state. As done by the companies to float a virtual company in a state. This action includes Limitation of Benefits (LOB) rules that limits the availability of treaty benefits to entities which meet certain conditions and Principal Purpose Test (PPT) rule, which denies the treaty benefit to an entity if the principal of transaction or arrangement is to obtain treaty benefits unless it is established that granting these benefits would be in according to objects and purpose of treaty provisions.

Permanent establishment Status (Action 7): This action plan contains the measures for Preventing the Artificial Avoidance of Permanent Establishment Status. The tax treaties includes the definition of permanent establishment (PE) generally in article 5. There are certain exclusions contained in the definition of permanent establishment. The entities misuse the exceptions provided in the article and also make other arrangement to avoid the PE status in the source state like commissionaire arrangements, using specific exceptions and splitting up of contracts to avoid the time limit criteria for construction projects. Further, this action also includes the measures to provide certainty and guidance on the issue of attribution of profit to PEs.

Mutual agreement procedures (MAP) (Action 14): This include measure related to Making dispute resolution mechanism more effective. The measures in the action plan aim to curtail the risks of uncertainty and unintended double taxation by ensuring the consistent and proper implementation of tax treaties, including the effective and timely resolution of disputes regarding their interpretation or application through the mutual agreement procedure. Countries have agreed to important changes in their approach to dispute resolution, such as a minimum standard with respect to the resolution of treaty-related disputes. The minimum standard will ensure that MAP are fully implemented in good faith and cases are resolved in timely manner, ensure that administrative processes are implemented to promote the prevention and timely resolution of treaty related disputes, ensure that eligible members can access the MAP.

Articles

The MLI is distributed in various Parts and Articles.

Part I

Article 1 – Scope of the Convention

Article 2 – Interpretation of Terms

Hybrid Mismatches (Part II)

| Article 3 – Transparent Entities | Article 5 – Application of Methods for Elimination of Double Taxation (Option A, Option B and Option C). |

| Article 4 – Dual Resident Entities |

Treaty Abuse (Part III)

| Article 6 – Purpose of a Covered Tax Agreement | Article 9 – Capital Gains from Alienation of Shares or Interests of Entities Deriving their Value Principally from Immovable Property |

| Article 7 – Prevention of Treaty Abuse | Article 10 – Anti-abuse Rule for Permanent Establishments Situated in Third Jurisdictions |

| Article 8 – Dividend Transfer Transactions | Article 11 – Application of Tax Agreements to Restrict a Party’s Right to Tax its Own Residents |

Avoidance of Permanent Establishment Status (Part IV)

| Article 12 – Artificial Avoidance of Permanent Establishment Status through Commissionnaire Arrangements and Similar Strategies | Article 14 – Splitting-up of Contracts, Article 15 – Definition of a Person Closely Related to an Enterprise. |

| Article 13 – Artificial Avoidance of Permanent Establishment Status through the Specific Activity Exemptions (Option A, Option B, No Option) |

Improving Dispute Resolution (Part V)

| Article 16 – Mutual Agreement Procedure | Article 17 – Corresponding Adjustments |

Arbitration (Part VI)

| Article 18 – Choice to Apply Part VI | Article 23 – Type of Arbitration Process |

| Article 19 – Mandatory Binding Arbitration | Article 24 – Agreement on a Different Resolution |

| Article 20 – Appointment of Arbitrators | Article 25 – Costs of Arbitration Proceedings |

| Article 21 – Confidentiality of Arbitration Proceedings | Article 26 – Compatibility |

| Article 22 – Resolution of a Case Prior to the Conclusion of the Arbitration |

Final Provisions (Part VII)

| Article 27 – Signature and Ratification, Acceptance or Approval | Article 34 – Entry into Force |

| Article 28 – Reservations | Article 35 – Entry into Effect |

| Article 29 – Notifications | Article 36 – Entry into Effect of Part VI |

| Article 30 – Subsequent Modifications of Covered Tax Agreements | Article 37 – Withdrawal |

| Article 31 – Conference of the Parties | Article 38 – Relation with Protocols |

| Article 32 – Interpretation and Implementation | Article 39 – Depositary |

| Article 33 – Amendment |

How does MLI impacted treaties?

Adoption by countries

The MLI now covers over 90 jurisdictions from all continents and all levels of development. It entered into force on 1 July 2018 and started to take effect with respect to covered tax agreements of jurisdictions that ratified it. Signatories and Parties that joined the MLI identified which of their existing tax treaties they wish to modify via the MLI and which of its provisions they wish to implement. Once a tax treaty has been listed by its two treaty partners, it becomes an agreement covered by the MLI. The effects of the MLI on a specific covered agreement are drawn from the “matching” of its partners’ choices. Current Signatories and Parties have listed over 2,800 treaties, already leading up to over 1,680 matched agreements. The number of modified tax treaties is expected to further increase as additional jurisdictions will join the MLI.

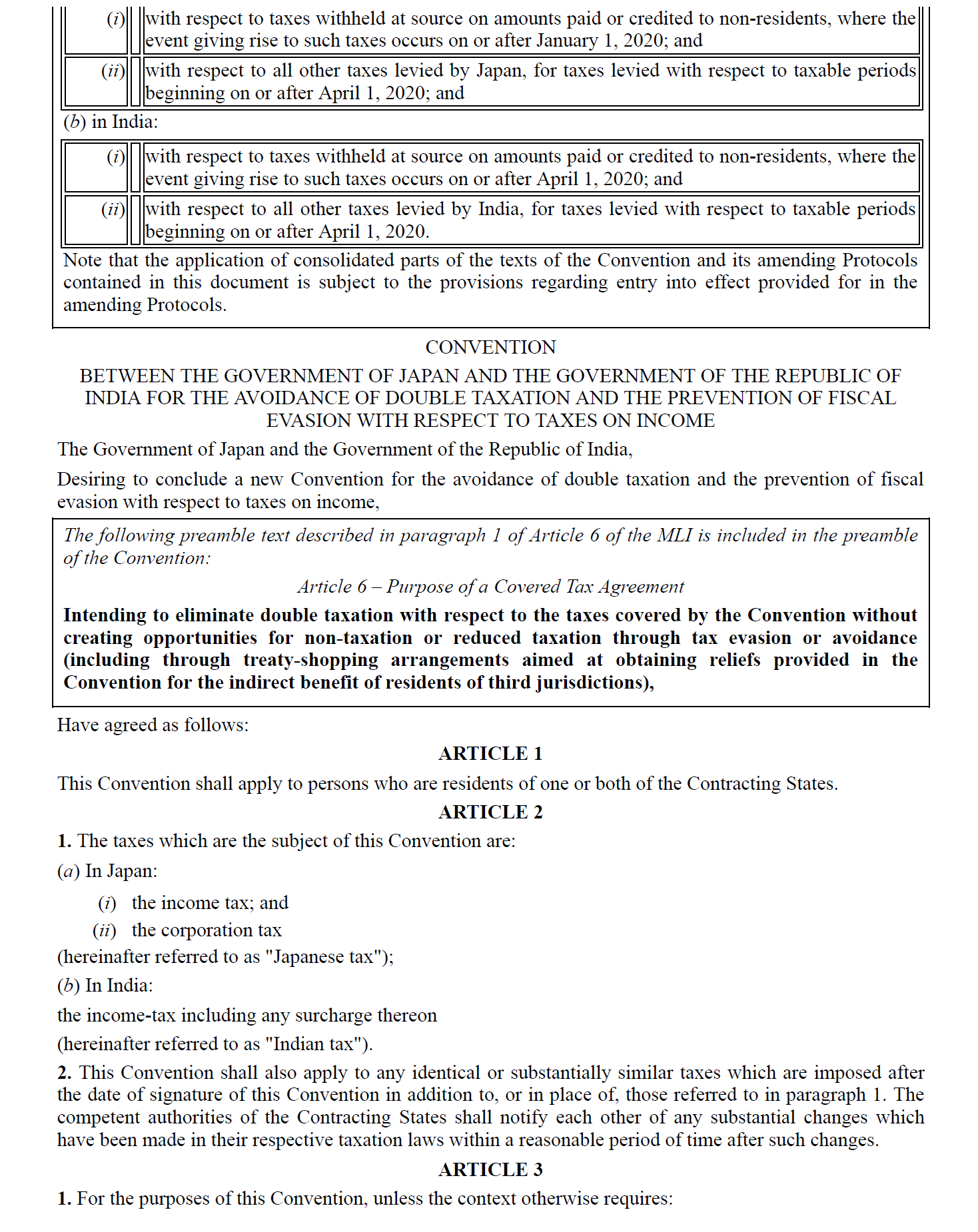

Article 35 sets out the general rules on the entry into effect and divides modifications into two categories based on the type of taxation to which they apply (provisions of the MLI with respect to taxes withheld at source on amounts paid or credited to non-residents and provisions of the MLI with respect to all other taxes levied).

How MLI affects the treaties?

The MLI become effective and how it impacts the covered tax treaty depends upon various question i.e. have both the jurisdictions signed the MLI and it comes into effect, has either country made a reservation on the application of any article of MLI, which available options has either country applied, notified tax treaties by contracting states to covered tax agreement. Although the jurisdictions have the right to choose any option, or to make any reservation but the same will be applicable for all notified tax treaties, so therefore treaty by treaty option not available. Once MLI has entered into effect from a specified date for a covered tax agreement (tax treaty), the matching articles/options adopted by both the countries will have been read with the tax treaty. Tax treaty to the extent of adopted articles in MLI will be modified. For the sake of convenience and better understanding OECD has also recommended drafting of synthesised text of tax treaties by the respective countries with certain disclaimers.

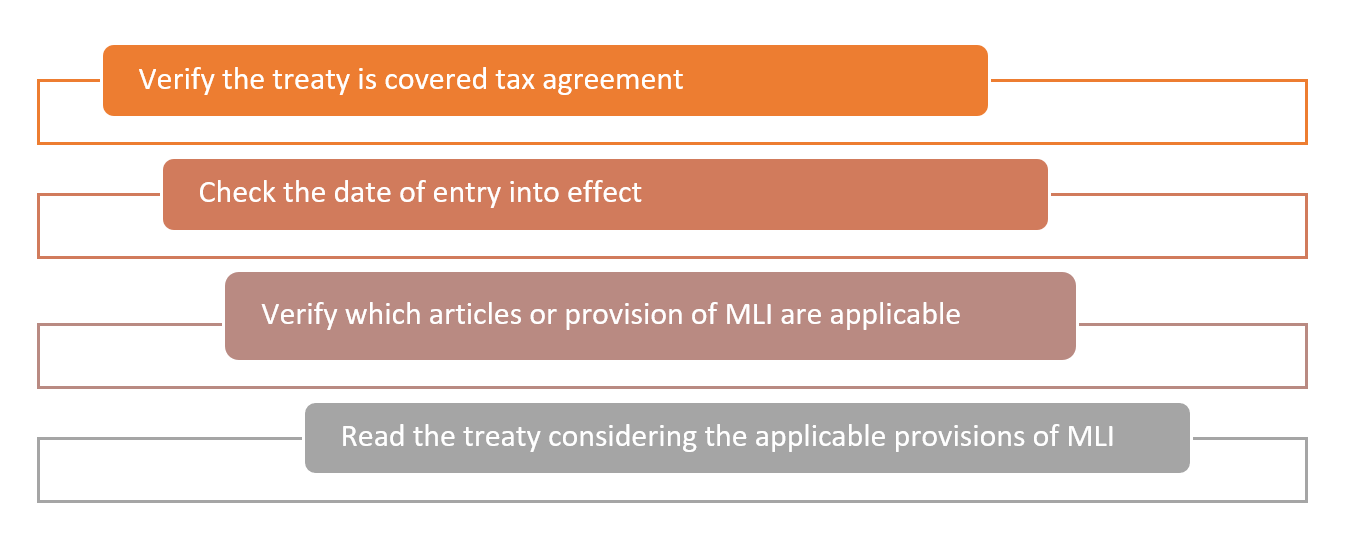

The process flow for application of MLI and reading of tax treaty is as under: –

Determine Effective date of application of MLI

What are the relevant dates?

Article 34 and 35 of MLI deals with the dates of entry into force and entry into effect.

Entry into force in respect of MLI is 1st July, 2018 i.e. 1st day of month after expiry of 3 months from date of deposit of 5th instrument of ratification, acceptance or approval. For each contracting jurisdiction 1st day of month after expiry of 3 months from the date of deposit of instrument of ratification, acceptance or approval by signatory.

Entry into Effect in respect of each contracting jurisdiction with respect to covered tax agreement will be as under:-

- With respect to Withholding tax (WHT) 1st day of next calendar year (or taxable year as per option of signatory) on or after the latest dates on which MLI enters into force for each -contracting jurisdiction. For example in case of India-Singapore treaty, India submitted ratification instrument on 25th June, 2019, so enters in to force on 1st October, 2019 for India. Singapore deposits ratification instrument on 21 Dec, 2018, so enters in to force on 1st April, 2019. So, the relevant date (latest date) is 1st October, 2019 and with respect to WHT, it entered into effect on 1st April, 2020 for India (taxable year) and 1st January, 2020 for Singapore (calendar year).

- With respect to all other taxes, taxable periods beginning on or after the expiry of period of 6 months from the latest dates on which MLI entered into force for each-contracting jurisdiction. In the above example of India-Singapore treaty, the entry into effect for India in respect of all other taxes, will be 1st April, 2020 and for Singapore it will be 1st January, 2021.

So, if the date of entry into effect for withholding tax is different from the date of entry into effect for other taxes, then a conscious decision should be taken by the payer, as withholding tax is the only way to collect tax from the non-resident’s payee. However, on the other side non-resident payee may always argue, that since date for primary liability to tax is applicable from different tax period, no withholding should be made.

Indian Treaties impacted by MLI

All Indian treaties to be impacted as of 15th May, 2020. The date of entry into force of MLI for India is 1st October, 2019.

| Country | Date of entry into force | Date of Entry into effect (WHT from Indian perspective) | Date of Entry into effect (Other taxes from Indian perspective) |

| Australia | 01-01-2019 | 01st April, 2020 | 01st April, 2020 |

| Austria | 01-07-2018 | 01st April, 2020 | 01st April, 2020 |

| Belgium | 01-10-2019 | 01st April, 2020 | 01st April, 2020 |

| Canada | 01-12-2019 | 01st April, 2020 | 01st April, 2021 |

| Croatia | 01-07-2019 | 01st April, 2020 | 01st April, 2020 |

| Cyprus | 01-05-2020 | 01st April, 2021 | 01st April, 2021 |

| Czech Republic | 01-09-2020 | 01st April, 2021 | 01st April, 2021 |

| Denmark | 01-01-2020 | 01st April, 2020 | 01st April, 2021 |

| Finland | 01-06-2019 | 01st April, 2020 | 01st April, 2020 |

| France | 01-01-2019 | 01st April, 2020 | 01st April, 2020 |

| Georgia | 01-07-2019 | 01st April, 2020 | 01st April, 2020 |

| Guernsey | 01-06-2019 | 01st April, 2020 | 01st April, 2020 |

| Iceland | 01-01-2020 | 01st April, 2020 | 01st April, 2021 |

| Indonesia | 01-08-2020 | 01st April, 2021 | 01st April, 2021 |

| Ireland | 01-05-2019 | 01st April, 2020 | 01st April, 2020 |

| Isle of Man | 01-07-2018 | 01st April, 2020 | 01st April, 2020 |

| Israel | 01-01-2019 | 01st April, 2020 | 01st April, 2020 |

| Japan | 01-01-2019 | 01st April, 2020 | 01st April, 2020 |

| Jersey | 01-07-2018 | 01st April, 2020 | 01st April, 2020 |

| Korea | 01-09-2020 | 01st April, 2021 | 01st April, 2021 |

| Latvia | 01-02-2020 | 01st April, 2020 | 01st April, 2021 |

| Lithuania | 01-01-2019 | 01st April, 2020 | 01st April, 2020 |

| Luxembourg | 01-08-2019 | 01st April, 2020 | 01st April, 2020 |

| Malta | 01-04-2019 | 01st April, 2020 | 01st April, 2020 |

| Mauritius | 01-02-2020 | 01st April, 2020 | 01st April, 2021 |

| Netherlands | 01-07-2019 | 01st April, 2020 | 01st April, 2020 |

| New Zealand | 01-10-2018 | 01st April, 2020 | 01st April, 2020 |

| Norway | 01-11-2019 | 01st April, 2020 | 01st April, 2021 |

| Poland | 01-07-2018 | 01st April, 2020 | 01st April, 2020 |

| Portugal | 01-06-2020 | 01st April, 2021 | 01st April, 2021 |

| Qatar | 01-04-2020 | 01st April, 2021 | 01st April, 2021 |

| Russian Federation | 01-10-2019 | 01st April, 2020 | 01st April, 2020 |

| San Marino | 01-07-2020 | 01st April, 2021 | 01st April, 2021 |

| Saudi Arabia | 01-05-2020 | 01st April, 2021 | 01st April, 2021 |

| Serbia | 01-10-2018 | 01st April, 2020 | 01st April, 2020 |

| Singapore | 01-04-2019 | 01st April, 2020 | 01st April, 2020 |

| Slovak Republic | 01-01-2019 | 01st April, 2020 | 01st April, 2020 |

| Slovenia | 01-07-2018 | 01st April, 2020 | 01st April, 2020 |

| Sweden | 01-10-2018 | 01st April, 2020 | 01st April, 2020 |

| Switzerland | 01-12-2019 | 01st April, 2020 | 01st April, 2021 |

| Ukraine | 01-12-2019 | 01st April, 2020 | 01st April, 2021 |

| United Arab Emirates | 01-09-2019 | 01st April, 2020 | 01st April, 2020 |

| United Kingdom | 01-10-2018 | 01st April, 2020 | 01st April, 2020 |

List of treated impacted w.e.f. 01st April, 2020

| Country | Date of entry into force | Date of Entry into effect (WHT from Indian perspective) | Date of Entry into effect (Other taxes from Indian perspective) |

| Australia | 01-01-2019 | 01st April, 2020 | 01st April, 2020 |

| Austria | 01-07-2018 | 01st April, 2020 | 01st April, 2020 |

| Belgium | 01-10-2019 | 01st April, 2020 | 01st April, 2020 |

| Canada | 01-12-2019 | 01st April, 2020 | 01st April, 2021 |

| Croatia | 01-07-2019 | 01st April, 2020 | 01st April, 2020 |

| Denmark | 01-01-2020 | 01st April, 2020 | 01st April, 2021 |

| Finland | 01-06-2019 | 01st April, 2020 | 01st April, 2020 |

| France | 01-01-2019 | 01st April, 2020 | 01st April, 2020 |

| Georgia | 01-07-2019 | 01st April, 2020 | 01st April, 2020 |

| Guernsey | 01-06-2019 | 01st April, 2020 | 01st April, 2020 |

| Iceland | 01-01-2020 | 01st April, 2020 | 01st April, 2021 |

| Ireland | 01-05-2019 | 01st April, 2020 | 01st April, 2020 |

| Isle of Man | 01-07-2018 | 01st April, 2020 | 01st April, 2020 |

| Israel | 01-01-2019 | 01st April, 2020 | 01st April, 2020 |

| Japan | 01-01-2019 | 01st April, 2020 | 01st April, 2020 |

| Jersey | 01-07-2018 | 01st April, 2020 | 01st April, 2020 |

| Latvia | 01-02-2020 | 01st April, 2020 | 01st April, 2021 |

| Lithuania | 01-01-2019 | 01st April, 2020 | 01st April, 2020 |

| Luxembourg | 01-08-2019 | 01st April, 2020 | 01st April, 2020 |

| Malta | 01-04-2019 | 01st April, 2020 | 01st April, 2020 |

| Mauritius | 01-02-2020 | 01st April, 2020 | 01st April, 2021 |

| Netherlands | 01-07-2019 | 01st April, 2020 | 01st April, 2020 |

| New Zealand | 01-10-2018 | 01st April, 2020 | 01st April, 2020 |

| Norway | 01-11-2019 | 01st April, 2020 | 01st April, 2021 |

| Poland | 01-07-2018 | 01st April, 2020 | 01st April, 2020 |

| Russian Federation | 01-10-2019 | 01st April, 2020 | 01st April, 2020 |

| Serbia | 01-10-2018 | 01st April, 2020 | 01st April, 2020 |

| Singapore | 01-04-2019 | 01st April, 2020 | 01st April, 2020 |

| Slovak Republic | 01-01-2019 | 01st April, 2020 | 01st April, 2020 |

| Slovenia | 01-07-2018 | 01st April, 2020 | 01st April, 2020 |

| Sweden | 01-10-2018 | 01st April, 2020 | 01st April, 2020 |

| Switzerland | 01-12-2019 | 01st April, 2020 | 01st April, 2021 |

| Ukraine | 01-12-2019 | 01st April, 2020 | 01st April, 2021 |

| United Arab Emirates | 01-09-2019 | 01st April, 2020 | 01st April, 2020 |

| United Kingdom | 01-10-2018 | 01st April, 2020 | 01st April, 2020 |

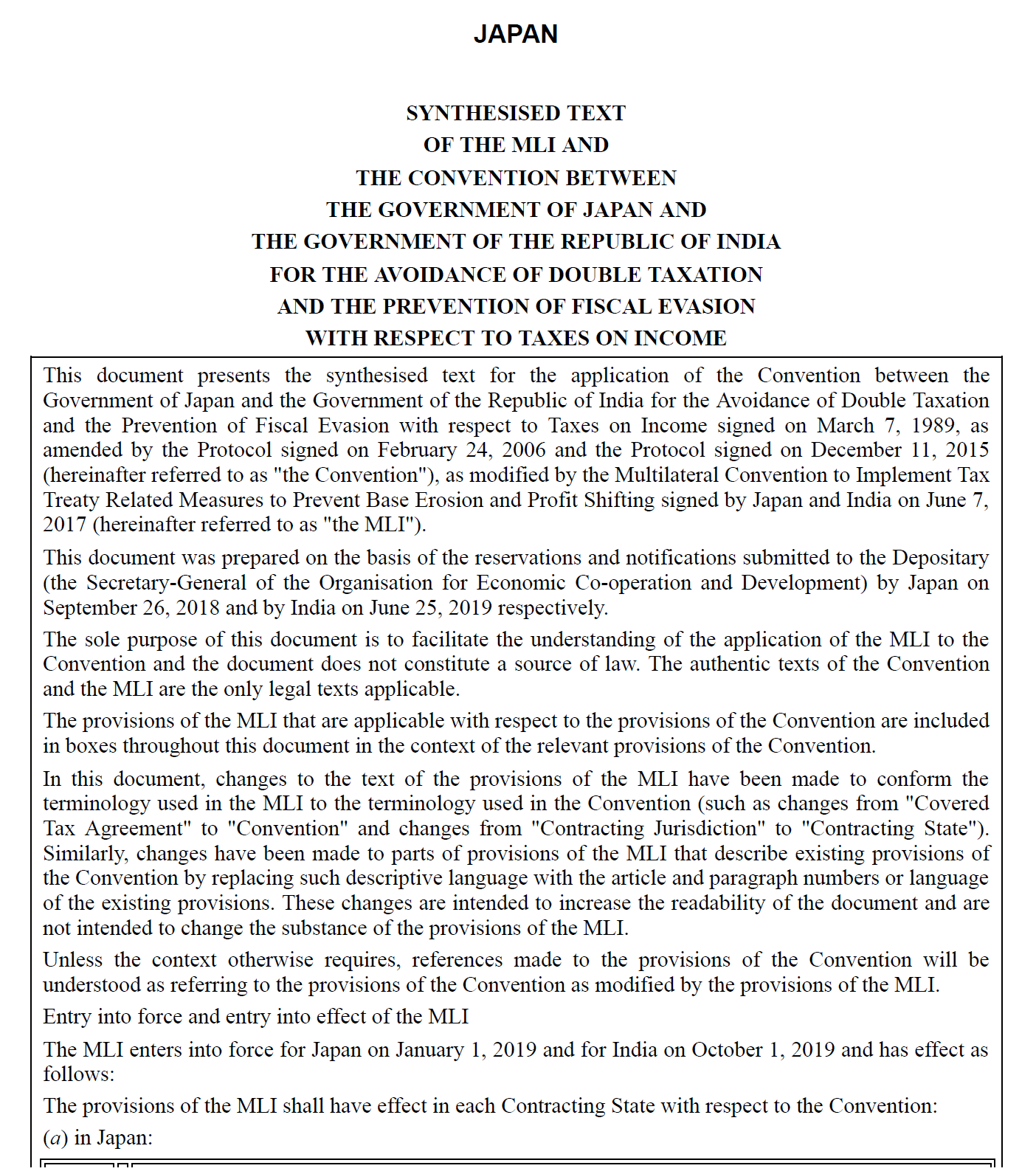

List of DTAAs where synthesised text available

India has published the synthesised tax (i.e. MLI provision incorporated in DTAA) of treaty with the following countries on its website https://www.incometaxindia.gov.in/Pages/international-taxation/dtaa.aspx

| 1. Slovenia | 8. United Kingdom | 15. Ireland |

| 2. Canada | 9. Austria | 16. Lithuania

|

| 3. Belgium | 10. Singapore | 17. Poland |

| 4. United Arab Emirates (UAE) | 11. Malta

|

18. Serbia

|

| 5. Latvia | 12. Georgia | 19. Slovak Republic |

| 6. Japan | 13. Luxembourg | |

| 7. Finland | 14. Australia |

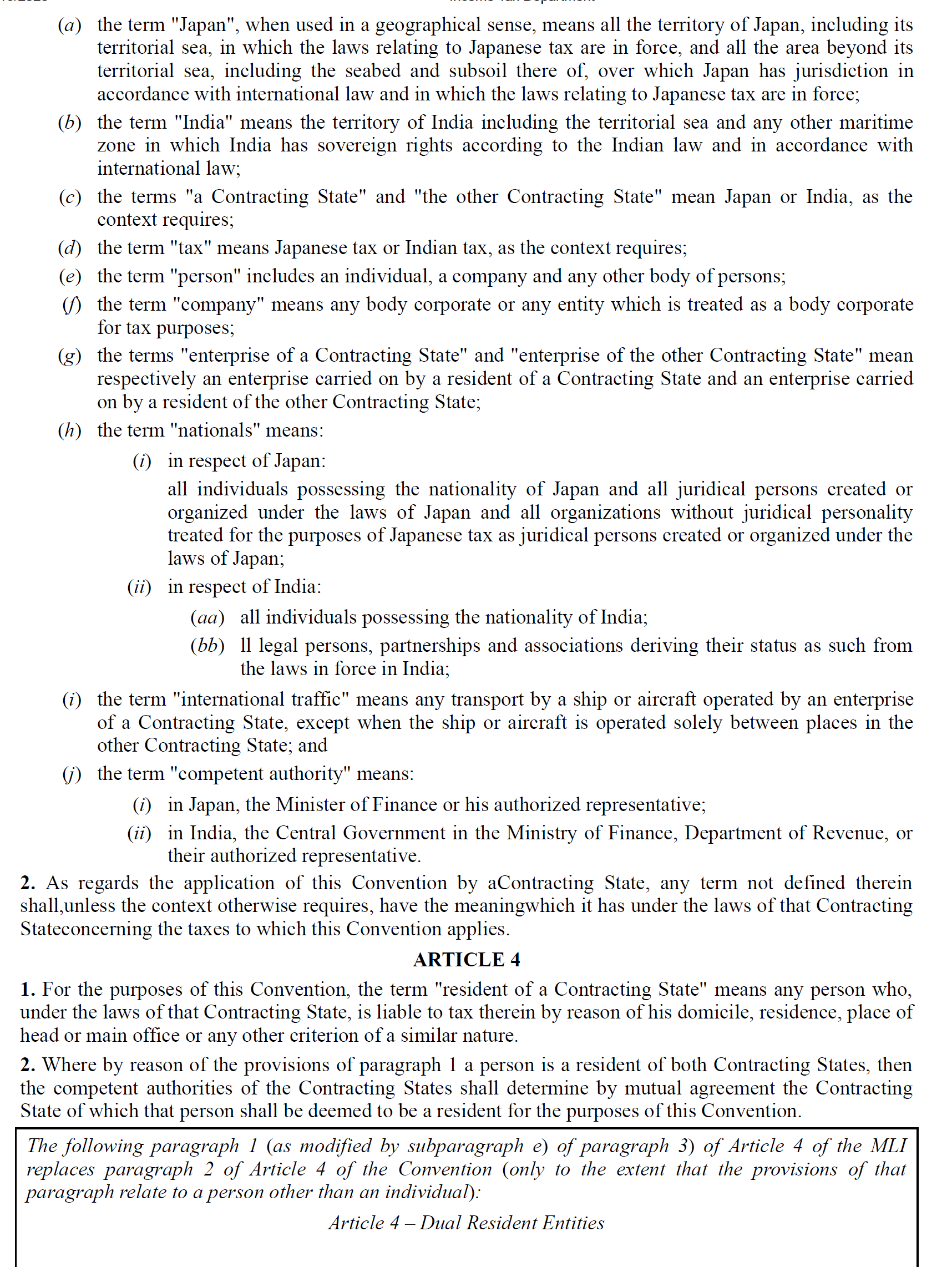

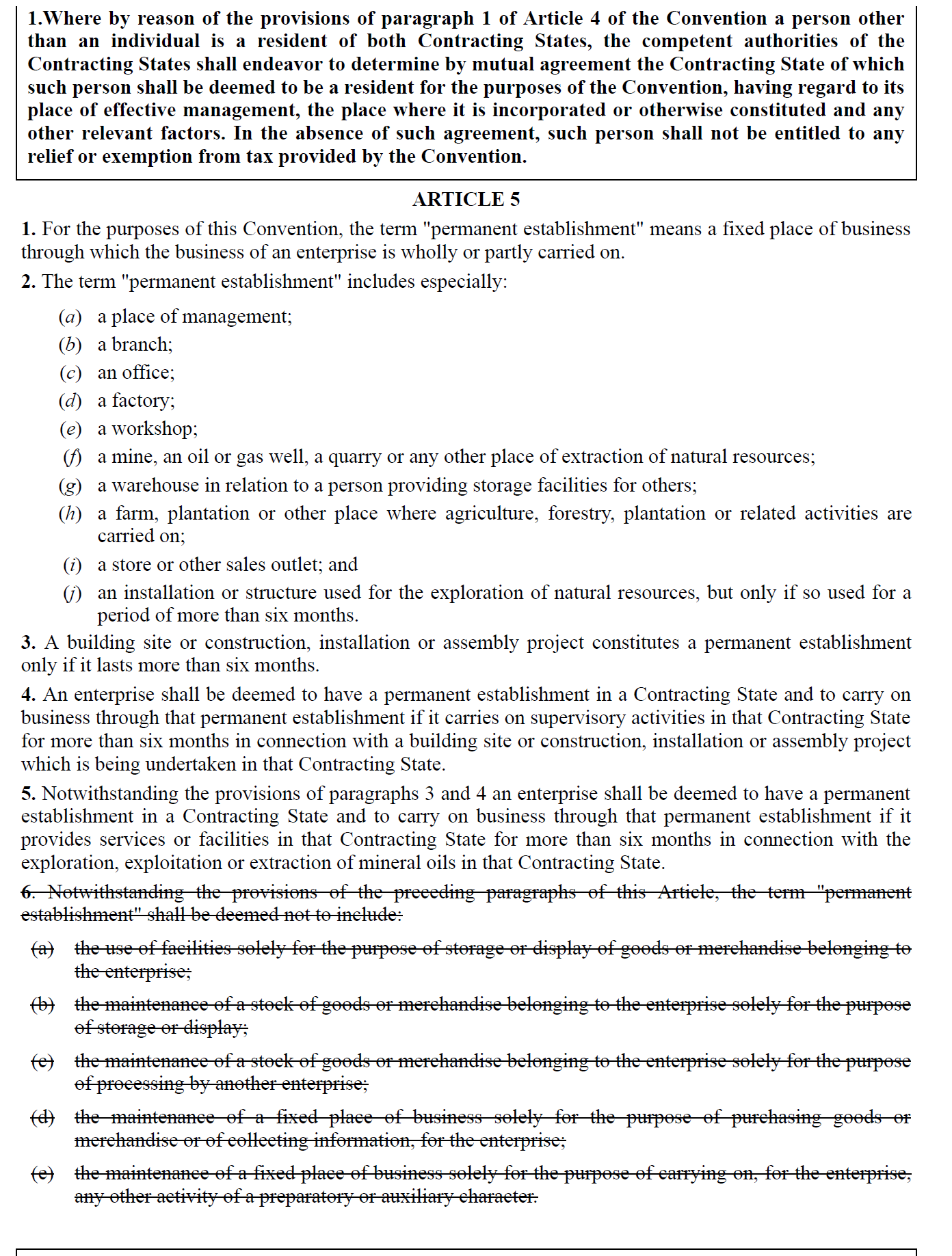

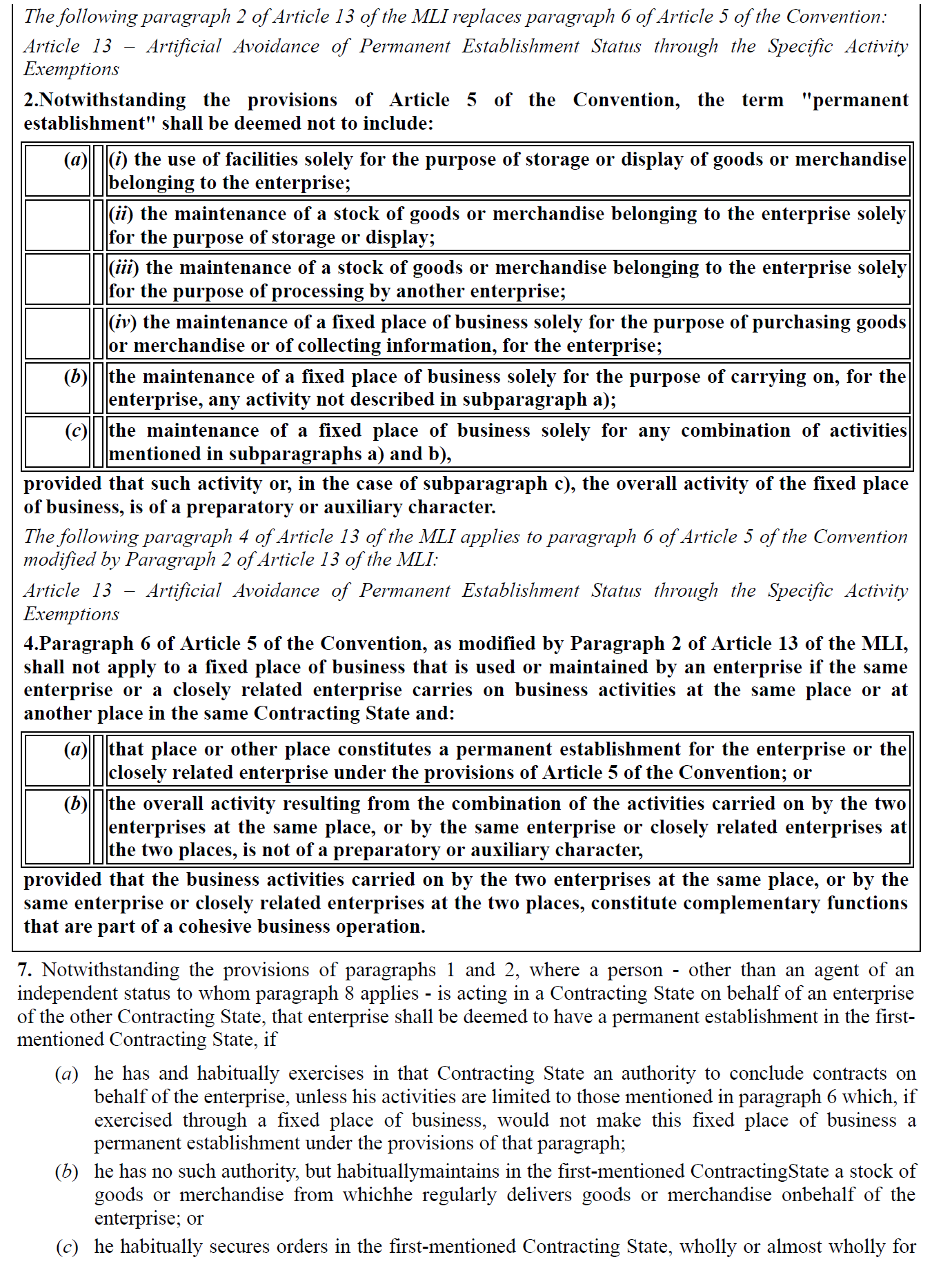

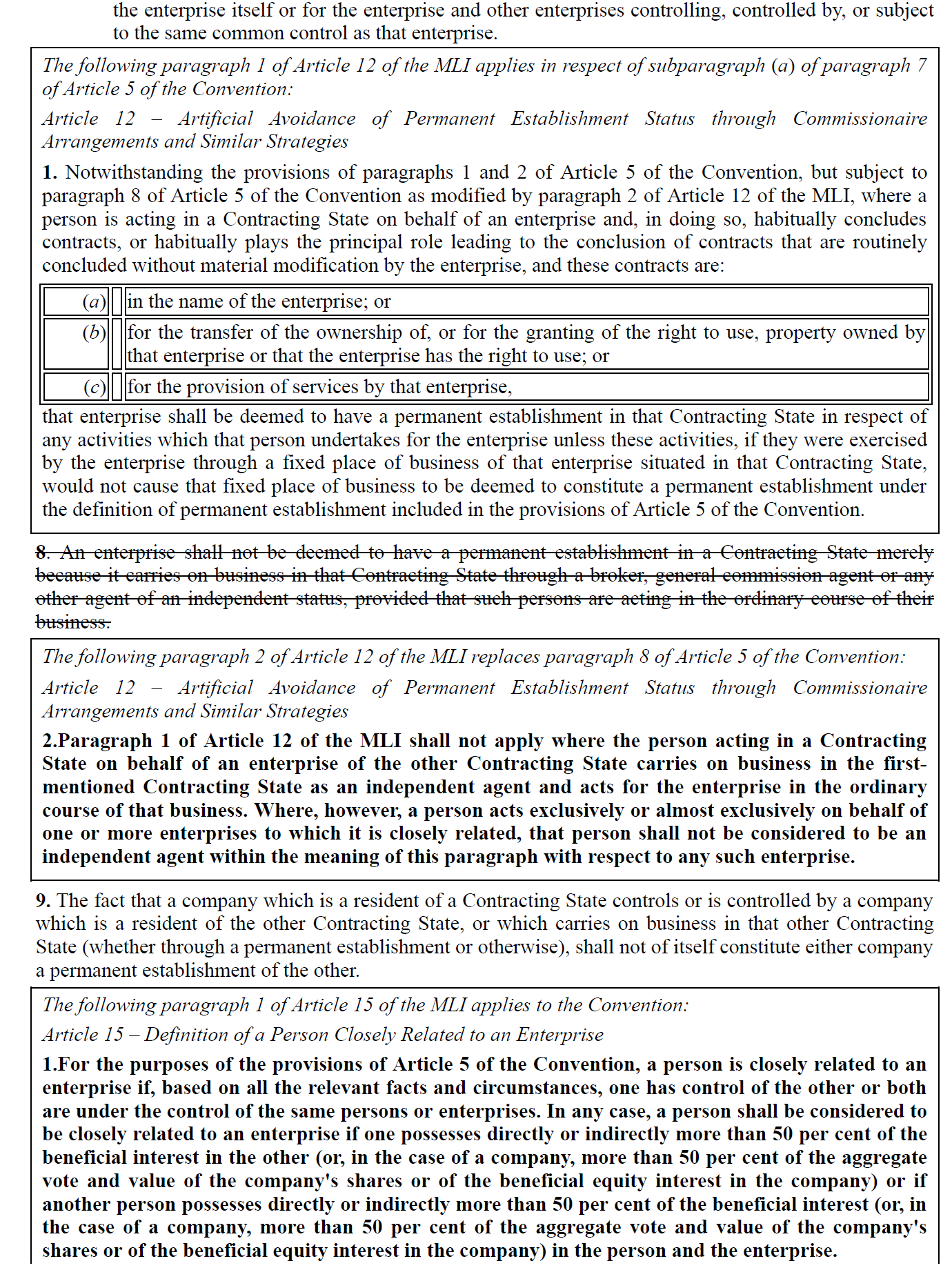

DTAA containing MLI provision (synthesised text)

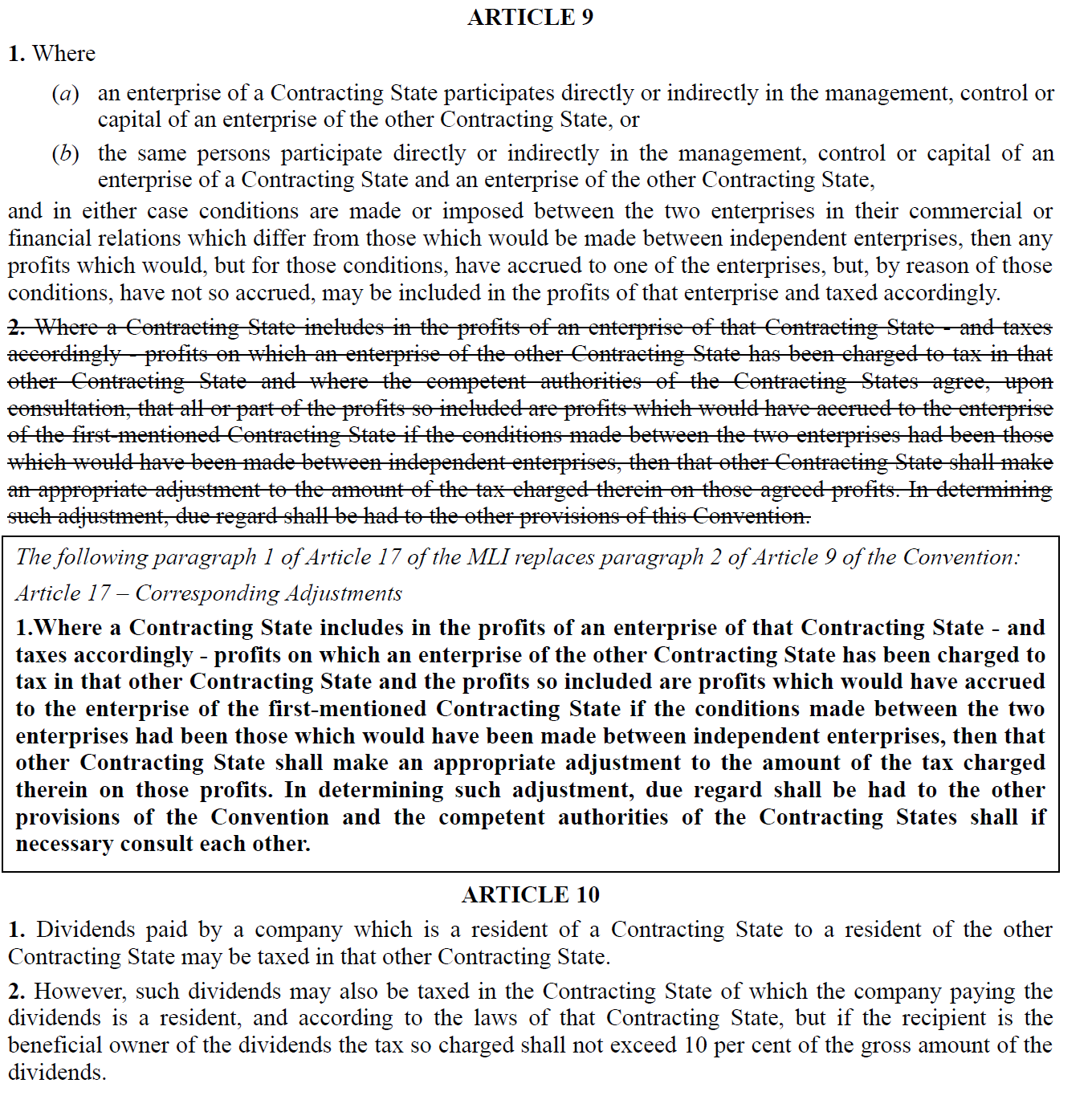

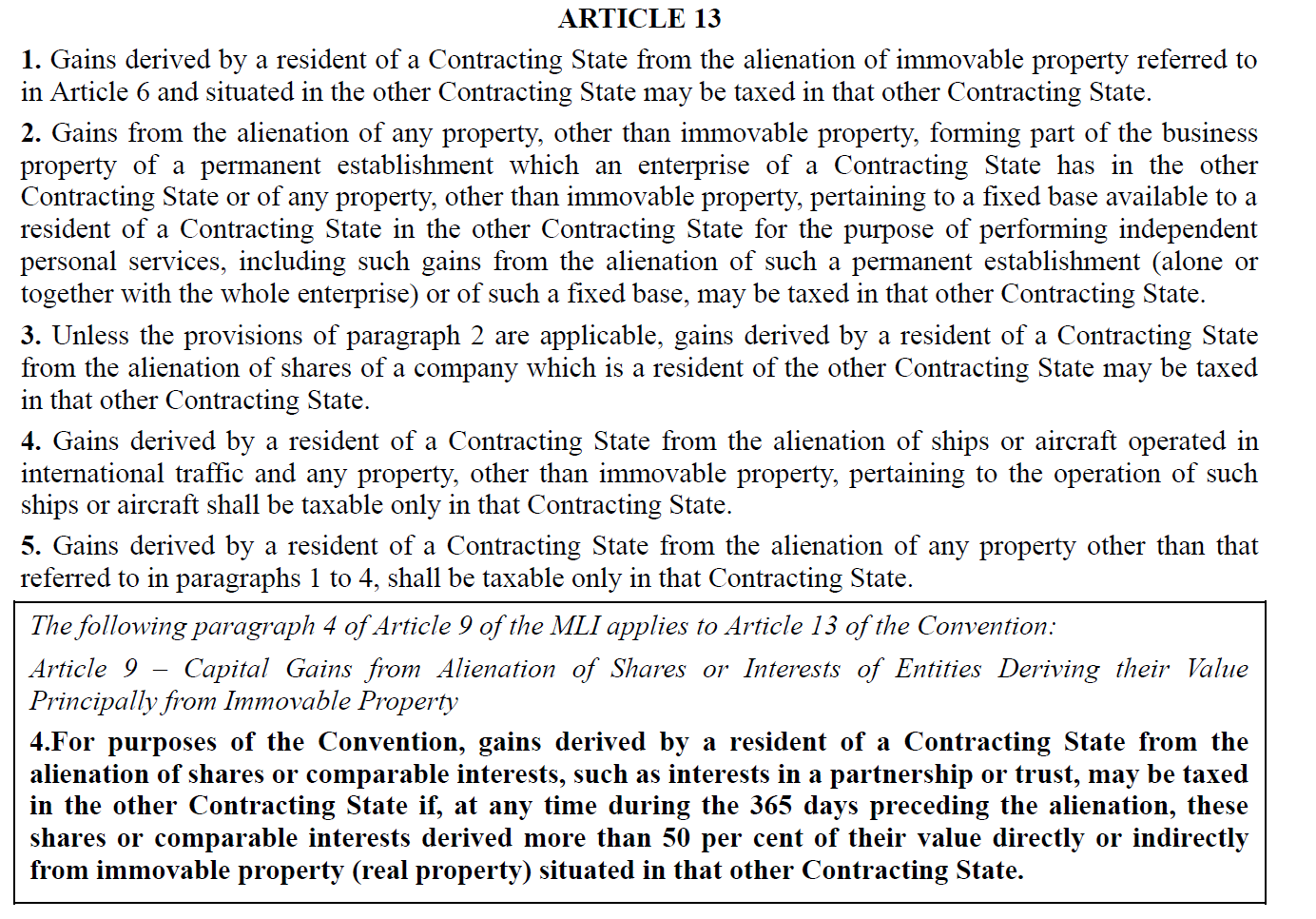

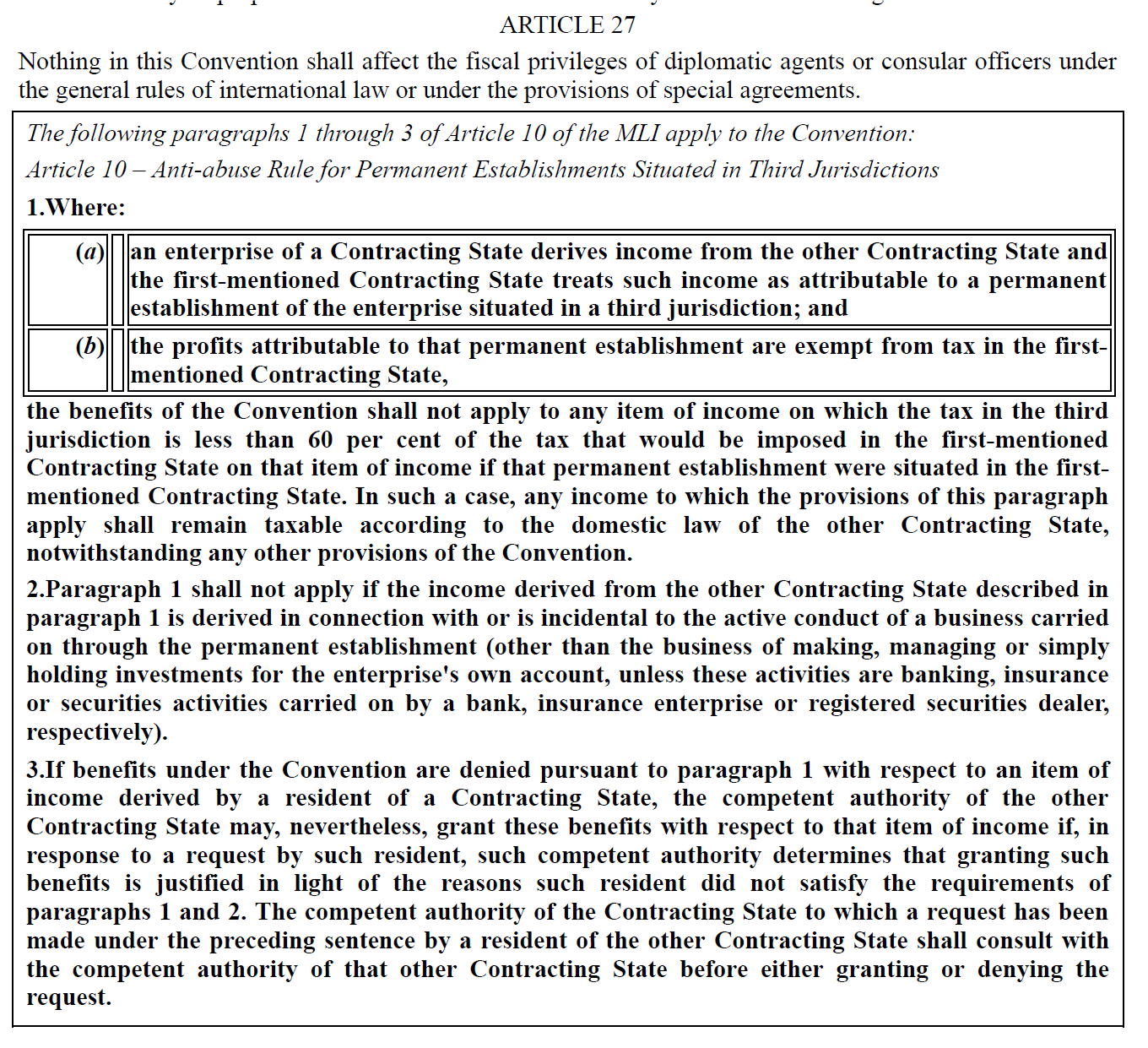

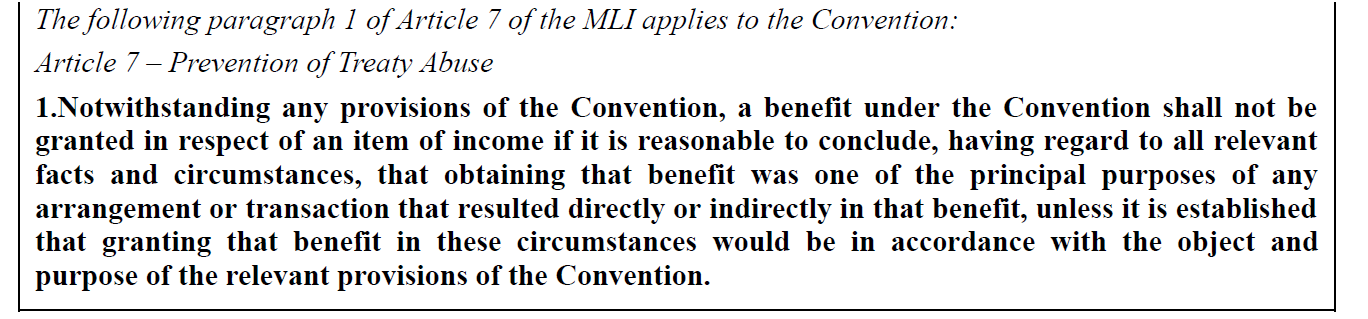

The screenshot of India-Japan (Synthesised text) treaty, relevant articles impacted due to MLI are as under:-

Brief summary of Important Articles and applicability on India treaties.

Detailed Articles

Article 3 Transparent Entities

Tax treaty benefits to be allowed to fiscally transparent entities for the income earned to the extent that such income is taxed in the jurisdiction in which the entity is a resident.

Article 4 Dual resident entities

Competent Authorities of both jurisdictions to mutually agree on the manner to determine the residential status of dual resident non-individuals regarding place of effective management, place of incorporation or constitution, and any other relevant factors. In the absence of such agreement, treaty benefits to be denied to such a person, unless otherwise agreed by them. Further, this article is also applicable where there is no specific provision in the covered tax treaty for dual residency of non-individuals.

Article 5 Application of methods to eliminate double taxation

This article prescribed three options for eliminating the double taxation

Option A: – Allow credit method in respect of tax paid on items of income and capital instead of exempt method for elimination of double taxation.

Option B: Allow credit method in respect of tax paid on dividend income instead of deduction method for calculating taxable profits.

Option C: Allow credit method in respect of tax paid on items of income and capital instead of exempt method for elimination of double taxation (except where the income taxable solely in source state). Further, income which is exempt by reasons to covered tax treaty may be included for calculating tax on remaining income or capital.

Article 6 Purpose of a Covered Tax Agreement

This article recommends to include a preamble text in covered tax agreement to eliminate double taxation without creating opportunities for non-taxation or reduced taxation through tax evasion or avoidance including through treaty shopping arrangements.

Article 7 Prevention of Treaty Abuse

This article prescribe three anti-abuse measures/ options to meet the minimum standard:-

- Principal purpose test (PPT):- Where the principal purpose of arrangement or transaction is to obtain the treaty benefit, unless contrary is established.

- PPT supplemented with either simplified limitation of benefits (SLOB) or detailed limitation of benefits (LOB) clause.

- Detailed LOB provision, supplemented by a mutually negotiated mechanism to deal with conduit arrangements not already dealt with in covered tax agreement.

Article 8 Dividend Transfer Transaction

This article prescribes the additional criteria of minimum holding for 365 days for availing concessional rate of tax under the covered tax agreement.

Article 9 – Capital Gains from Alienation of Shares or Interests of Entities Deriving their Value Principally from Immovable Property

This article prescribes the additional criteria of 365 days minimum holding period in case of gains arising from alienation of shares or other participation rights if such shares or rights derive more than a specified percentage of their value from immovable property situated in the source jurisdiction. Further, optional provision of inserting a minimum value derivation criterion of 50 percent of their value directly or indirectly from immovable property during the preceding 365 days.

Article 11: Application of tax agreement to restrict a party’s right to tax its own residents

This article prescribed the rules to preserves the right of jurisdiction to tax its own residents.

Article 12 – Artificial Avoidance of Permanent Establishment Status through Commissionaire Arrangements and Similar Strategies

The articles prescribes the rules to widen the definition of PE given in tax treaties to include cases where a person habitually concludes contracts or plays a principal role in conclusion of contracts of another enterprise.

Article 13 – Artificial Avoidance of Permanent Establishment Status through the Specific Activity Exemptions

The article provides two options to tackle artificial avoidance of PE status through specific activity exemptions. Option A states that exemption from PE is available only if the activities carried on are of preparatory and auxiliary nature. Additionally, it provides for anti-fragmentation rule. Option B states that exemption from PE is only for the activities of preparatory and auxiliary nature only those mentioned in covered tax agreement in addition to anti-fragmentation rule.

Article 14 – Splitting-up of Contracts

This article prescribes the rules to tackle the artificial avoidance of PE status through spilling up of single contract into multiple by avoiding the time limit threshold in the covered tax agreements. This rule is applicable in case of an activity by closely related enterprises constitutes a building site, construction project, installation project or other project specified in relevant covered tax agreement and where the overall activity exceeds the period of 30 days but not the threshold mentioned in covered tax treaty and each activity exceeds 30 days period of time.

Article 15 – Definition of a Person Closely Related to an Enterprise

This rule prescribes the definition of closely related person for the purpose of Article 12, Article 13 and Article 14. It means one has control of the other or both are under the control of the same persons or enterprises, if one possesses directly or indirectly more than 50 per cent of the beneficial interest/voting power.

Each contracting jurisdiction has the right to reservation on this entire article.

In most of the articles contracting jurisdiction has the right to the make reservation on any part of whole of the articles, while meeting the minimum standards.

India’s position to articles

| Article of MLI | Description of Article

|

India’s Position |

| Article 2: Interpretation

of terms |

Notification of tax treaties covered by MLI convention | India has notified 93 tax treaties except China and Marshall Islands |

| Article 3: Transparent entities | Tax treaty benefits to be allowed to fiscally transparent entities for the income earned to the extent that such income is taxed in the jurisdiction in which the entity is a resident | India has made a reservation and thus, not applicable to its CTAs |

| Article 4: Dual resident entities | CAs of both jurisdictions to mutually agree on the manner to determine the residential status of dual resident non-individuals regarding place of effective management, place of incorporation or constitution, and any other relevant factors. In the absence of such agreement, treaty benefits to be denied to such a person, unless otherwise agreed by them. | India has opted for application of such provision; said provision to apply to all its CTAs unless reservation is made by other CTA partner. |

| Article 5: Application of methods to eliminate double taxation | Recommends three options for elimination of double taxation inter-alia including “Option C”, which prescribes application of credit method | India has chosen to apply Option C i.e., credit method; the said option to apply to all its CTAs for its own residents Indian tax treaties generally contains credit method except in select cases. For e.g., tax treaty with Bulgaria, Greece, Egypt, Slovak Republic that contains exemption method. Therefore, exemption method in such select cases to be replaced by “credit method”. |

| Article 6: Purpose of CTA (minimum standard) | Introduces preamble text in CTA stating that the jurisdictions intend to avoid creation of opportunities for non-taxation or reduced taxation through tax evasion or avoidance, and through treaty shopping | India is silent on its position. Being minimum standard, such MLI provision to apply to all its CTAs |

| Article 7: Prevention of treaty abuse (minimum standard) | Envisages following three anti-abuse measures to meet the minimum requirement:

A. PPT B. PPT supplemented with either SLOB or detailed LOB clause C. Detailed LOB provision, supplemented by a mutually negotiated mechanism to deal with conduit arrangements not already dealt with in CTA |

India has opted for PPT + SLOB. PPT being minimum standard, it will apply to all its CTAs. India has accepted to apply PPT as an interim measure and intends where possible to adopt LOB provision, in addition or replacement of PPT, through bilateral negotiation. Not opted for competent authority route under Article 7(4) of MLI and thus, not applicable. SLOB to be applicable only where other CTA partner has adopted it or allowed India to apply SLOB asymmetrically. |

| Article 8: Dividend transfer transactions | Introduces additional criteria of “365 days minimum holding period” for the shareholder to avail concessional tax rates under CTA | India has opted to apply such provision (except in case of India-Portugal tax treaty, which already contains similar provision). Thus, said MLI provision to apply to all its CTA except India-Portugal treaty (unless reservation is made by other CTA partner) |

| Article 9: Capital gains from alienation of shares or interest of entities deriving their value principally from immovable property | Introduces additional criteria of “365 days minimum holding period” in case of gains arising from alienation of shares or other participation rights if such shares or rights derive more than a specified percentage of their value from immovable property situated in the source jurisdiction. Optional provision of inserting a minimum value derivation criterion of 50 percent of their value directly or indirectly from immovable property. | India has opted to apply minimum holding

period threshold along with minimum value derivation criterion of 50 percent. The said provision to apply to CTA only if other CTA partner has chosen to apply the said provision |

| Article 10: Anti-abuse rule for PE in third jurisdiction | Addresses abuse of CTAs in a triangular situation. | India is silent on its position; the said provision to apply to all its CTA, unless reservation is made by any other CTA partner. |

| Article 11: Application of tax agreement to restrict a party’s right to tax its own residents | Preserves the right of jurisdiction to tax its own residents | India is silent on its position; the said provision to apply to all its CTA, unless reservation is made by any other CTA partner. |

| Article 12: Artificial avoidance of PE status through commissionaire and similar strategies | Widens the definition of PE given in tax treaties to include cases where a person habitually concludes contracts or plays a principal role in conclusion of contracts of another enterprise | India has opted to apply the said provision; the said provision to apply to a CTA only if any other CTA partner has chosen to apply the said provision |

| Article 13: Artificial avoidance of PE through specific activity exemptions | Provides two options to counter artificial avoidance of PE status through specific activity exemptions. “Option A” states that exemption from PE is available only if the activities carried on are of preparatory and auxiliary nature. Additionally, it provides for anti-fragmentation rule | India has chosen to apply Option A; the said option to apply to CTA only if other CTA partner has chosen same option. India has chosen to apply antifragmentation rule; the said rule to apply to a CTA only if other CTA partner has chosen to apply the said provision |

| Article 14: Splitting up of contracts | Addresses avoidance of PE by splitting the contracts between related enterprises to circumvent the threshold of PE creation. | India is silent on its position; the said provision to apply to all its CTA, unless reservation is made by any other CTA partner. |

| Article 15: Definition of a person “closely related to an enterprise” | Defines the term “person closely related”, in the context of Articles 12, 13, and 14 of the MLI | India is silent on its position; the said provision to apply to all its CTA, unless reservation is made by any other CTA partner. |

| Article 16: Mutual agreement procedure (Minimum standard) | Requires MAP request to be made to either state, or implement a bilateral notification or consultation process. | India has reserved its right for not adopting the modified MLI provisions on the basis that it will meet the minimum standard by allowing MAP access in the resident state and implementing bilateral notification or consultation process. |

| Article 17: Corresponding adjustments | Requires jurisdictions to make appropriate corresponding adjustments in transfer pricing cases | India has chosen to apply the said provision except for CTAs where the provisions already exist. Bilateral APA and MAP allowed even in absence of Article 9(2) – as clarified by CBDT vide press release dated 27 November 2017. |

| Article 18-26: Mandatory binding arbitration | Provides mandatory binding arbitration in cases where competent authorities are unable to reach an agreement to resolve a case under MAP | India has not opted for mandatory arbitration. |

| Article 35: Entry into effect | Effect of provisions of the MLI | India has chosen to substitute “calendar year” with “taxable period”. If other CTA partner opts for calendar year, date of applicability of MLI provision for such other CTA partner will differ via-a-vis as for India |

How does MLI impact on withholding tax u/s 195

Section 195 of the Act deals with withholding tax on payments to non-residents and foreign companies. While making payment to any person, being non resident or foreign company, payer is required to assess the income tax liability of the payee as per the provisions of income tax act. Further, section 90 of the Act also provide the option to select the beneficial provision among the provisions of income tax act or double tax avoidance agreement with the country of residence of payee. As per the provisions of section 90 beneficial provisions are applicable where the payee has provided to the payer, Tax residency certificate (TRC) for being the residence of contracting state and form 10F (for additional information). After the MLI entered into effect, the payer should ensure to obtain the PE declaration keeping in mind the various articles of MLI, further additional declaration for principal purpose test (PPT) and LOB (limitation of benefit clause). Further, income tax act also cast additional responsibility on the payer to exercise due diligence while making withholding tax as otherwise the payer may fall into trouble in respect of TDS default u/s 201 and expense disallowance u/s 40(a)(i) of the Act.

Withholding on gross vs net (Permanent establishment)

Where in case of any payment in the nature of royalty or fee for technical services the payment is required to be made on gross basis i.e. TDS on gross payments at the rates specified in the DTAA (CTA) or rates specified under the income tax act and in case due to post MLI covered tax agreements (DTAA) the payee ends up having permanent establishment in India, tax is required to be paid on Net basis (i.e. after deducting the expenses), so in those cases it is better for the payee to apply for lower deduction tax certificate. However, the payee can always claim beneficial provisions under the income tax act, wherever applicable.

Denial of benefit of DTAA (Principle purpose test, Dividend and share transfer)

The article 7 of MLI has modified the tax treaties between the treaty partners to include principal purpose test as one of the minimum standard to allow the benefit of treaty provisions. Where it is observed by the contracting jurisdiction that the principal purpose of the arrangement or transaction is to obtain the benefit of treaty provisions or in case of treaty shopping, benefit would be denied to the payee or benefit would be allowed subject to some conditions (LOB), unless it is established by the payee that the arrangement was not aimed to only take the benefit of treaty through treaty shopping.

Further, article 8 of the MLI has modified the tax treaties provisions related to dividend income taxability to include the minimum holding of security for period of 365 days to avoid arrangement to transfer shares/ companies before the record date, however there are certain exceptions to these rules.

Further, article 9 of the MLI has modified the tax treaties provisions related to alienation of shares or interest in entities deriving certain percent of its value from immovable property to include the condition that the if during the preceding 365 days from the alienation, such shares or interest in entity deriving 50 per cent or more value from immovable property situated in a source state, then such transaction may be taxes in the state where such immovable property is situated.

However, in all the above articles, the payee can avail the benefit of income tax provision due to the operation of section 90 of the Act.

GAAR vis a vis MLI

GAAR stands for General anti avoidance rules under the provisions of income tax act applicable from 1st April, 2017. These provisions are similar to principal purpose test of MLI, where the purpose is to tackle the tax avoidance through various modes by the tax payers whether domestic or international transaction.

Comparison

Brief comparison of GAAR provisions with Principal purpose test of MLI is given below:-

| Particulars | GAAR Provisions | Principal Purpose test in MLI |

| Objective | To tackle the situations where main purpose is to take the tax benefit. | To tackle the situations where the principal purse is to be taken the tax benefit through treaty shopping. |

| Applicability | It becomes applicable where one of the test is satisfied with the objective to avoid tax liability. | It becomes applicable where the arrangement or transaction is not in accordance with the object and purpose of treaty. |

| Onus to prove | The primary onus to prove is on the income tax department. | The primary onus is on tax authority and rebuttal assumption for carve out |

| Consequences | Transaction may be reclassified, income may be reallocated or treaty benefits may be denied etc. | Treaty benefits will be denied. |

| Prescribed threshold | Yes, 3 crore tax amount. | No minimum threshold. |

| Grandfathering of investment already in existence. | Yes | No |

| Administrative safeguards | There is an Approving panel. | To be determined by the contracting countries. |

Due diligence and Documents required by Payer for foreign remittances (Post MLI)

There would be certain modifications post MLI in the tax treaty which are applicable from 1st April, 2020 which would require more professional due diligence while deciding the rate, amount and relevant article of tax treaty (DTAA) and proper documentation.

List of documents and declarations.

While making any payment to non-residents, payer is deemed to be its agent in India and he is the person for recovery of tax on behalf of non-resident payee. The payer while making withholding tax is required to exercise due diligence by making proper efforts and maintaining proper documents. The post MLI situation is more significant, as now the payer in addition to obtain TRC and other documents, is also required to exercise due diligence while deciding the PE situation, making dividend transfers, alienation of shares and interest in entities deriving value from immovable property etc. So, post MLI i.e. 1st April, 2020 following documents may be kept by payer for its safeguard, apart from due diligence:-

- TRC along with form 10F

- Beneficial ownership undertaking

- PE declaration along with undertaking/declaration with respect to Article 12 to Article 14 of MLI.

- PPT and LOB declaration (Article 7 of MLI)

- Dividend transfer (365 days) declaration (Article 8 of MLI)

- Declaration with regard to alienation of shares related to immovable property (Article 9 of MLI).

Where despite the possible efforts the payer is not able to obtain the necessary documents, then situation (depending on facts) may be treated as impossibility of performance.

There was need of clarification from CBDT regarding documentation for withholding tax purpose which become more important post MLI application.

***